Big retailers are encouraging shoppers to start their holiday shopping sooner rather than later this year. While it seems like retailers prep for the holidays earlier and earlier every year, this time it’s not just a marketing ploy. Everyone from the CDC to manufacturers is pushing the “shop early” message to thwart the effects COVID-19 will likely have on the yuletide season.

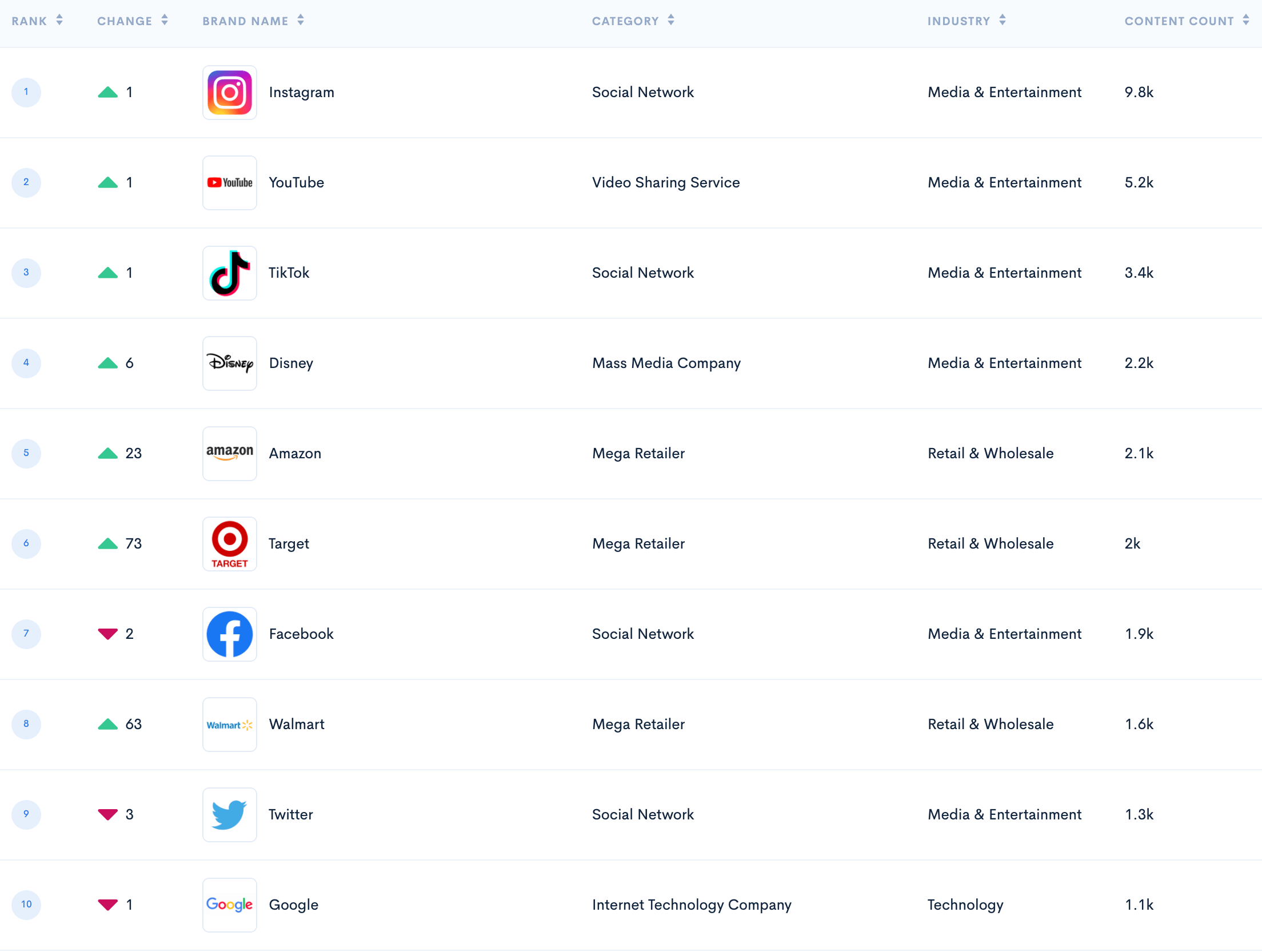

BrandGraph 500, which ranks the nation’s top brands by social content volume, shows Walmart, Target, and Amazon all had sharp increases in social content.

The chart below shows the top 10 brands with the highest content count in September 2021. Target climbed 73 spots, Walmart went up 63 spots, and Amazon moved up 23 spots – and holiday shopping is likely why these brands are climbing the chart.

Retailers want consumers to shop now

As you might suspect, COVID-19 is behind the motivation to get shoppers to take action. Consumers who shop in crowded stores, especially on Black Friday or Christmas Eve, are at a higher risk of COVID exposure. The Centers for Disease Control and Prevention just added ‘shopping in a crowded store’ to its list of high-risk activities.

The pandemic has also damaged the world’s supply chain. In many stores, inventory is low and delivery times are sluggish.

These factors create a COVID holiday storm, and if consumers don’t want to feel its wrath, shopping early is the answer.

Walmart releases deals and hiring news

Retailers usually wait to release their coveted holiday deals until the end of October, but not this year. In September, Walmart released a complete digital guide of kid-approved holiday gifts with in-store availability and shipping times listed on every item.

In addition to the retailer’s toy list, the company is also actively recruiting 150,000 employees to help with the holiday rush this year. This is on top of an estimated 20,000 employees the company needs to manage its curbside and delivery services that became wildly popular during the pandemic.

The announcement had everyone from news outlets to stock investors buzzing.

Walmart plans supply chain hires to staff-up distribution and fulfillment centers in anticipation of holidays https://t.co/DlYZ30A7mT pic.twitter.com/eolTl2YveQ

— Forbes (@Forbes) September 1, 2021

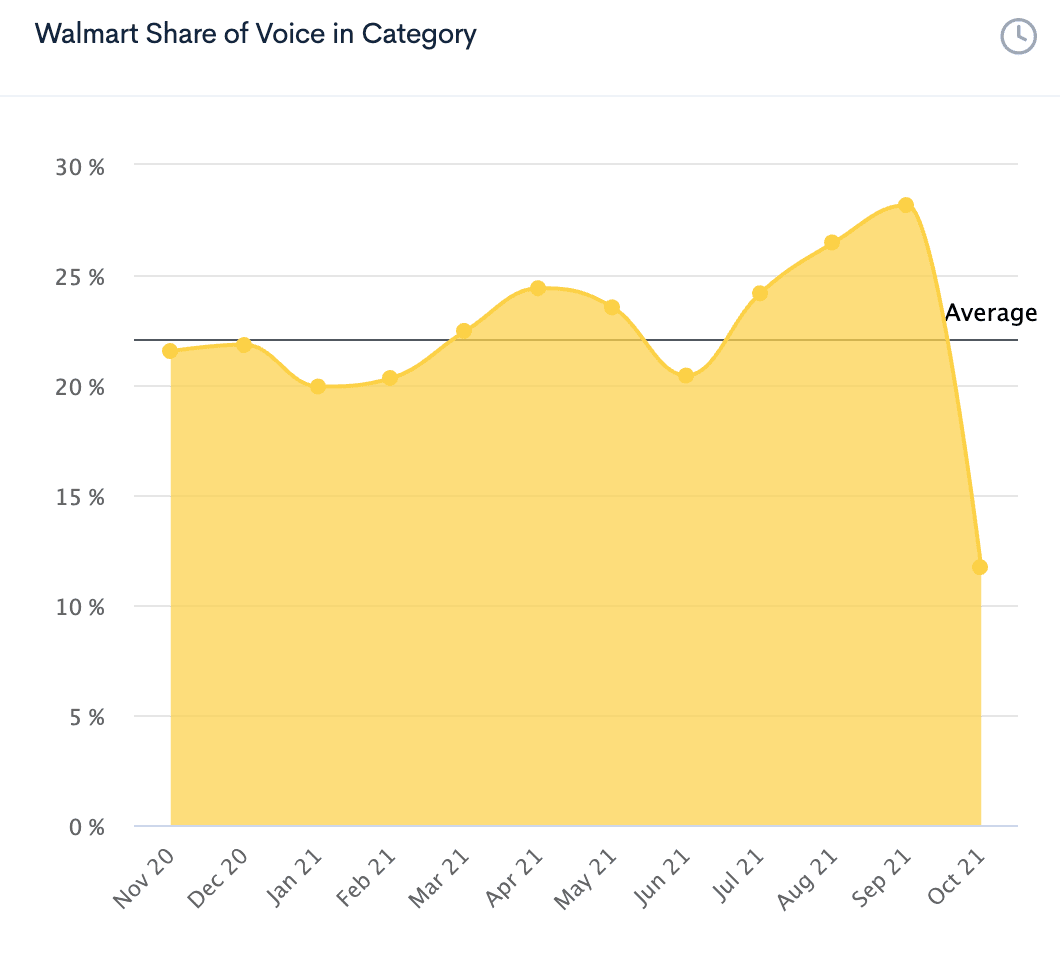

Posts like this one from @Forbes not only sparked social conversation but have Walmart’s share of voice at an all-time high for the year.

Amazon releases deals early

Meanwhile, Amazon released Black-Friday-like deals as well. Hot items like Apple Airpods and Le Creuset baking dishes are all on sale now, about a month earlier than usual.

And the Twittersphere started talking about it. For instance, @vougemagazine put together a list of beauty products that are part of Amazon’s holiday deals.

Great for early holiday shopping: https://t.co/75sjvOSTT2

— Vogue Magazine (@voguemagazine) October 6, 2021

And wellness influencer @iamwellandgood curated her own list of gifts from Amazon’s holiday deals and shared it with her 100k+ Twitter followers.

Ready or not: Holiday shopping season has officially startedhttps://t.co/rfhWIs8fLO

— Well+Good (@iamwellandgood) October 6, 2021

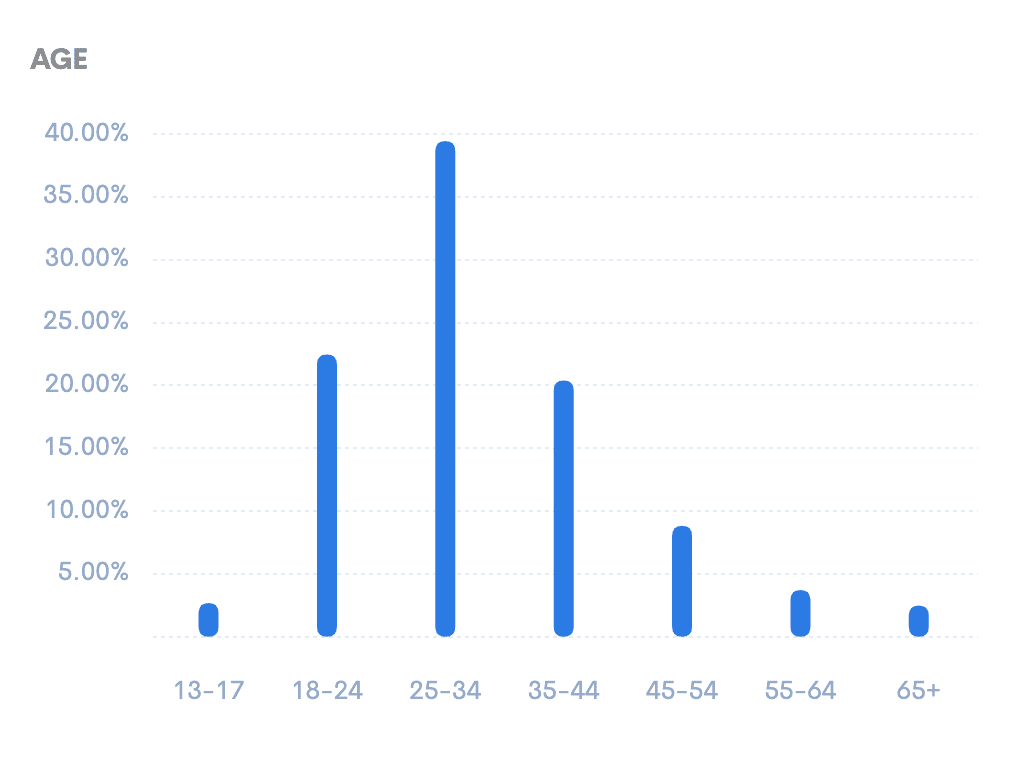

Interestingly, BrandGraph provides detailed information about the people who share this kind of content, including the average age of Amazon’s top content creators. Research shows about 40% of creators are between the ages of 25-34 and another 20% are between the ages of 35-44.

Target announces pay hikes for holiday hours

While Target is keeping its holiday bargains under wraps, the retailer made headlines by announcing a holiday pay increase. Employees who work in stores, at service centers, or help manage the supply chain will receive a $2 an hour pay bump on certain days when things are hectic – like the weekends leading up to Christmas.

The brand hopes the pay increase aids in employee retention and maybe even encourages current staff to pick up overtime hours amid a labor shortage.

Content creators like @AlbertFong shared the story with his Twitter followers:

If you're a Target employee, your paycheck just got a little eggnog with a dash of nutmeg thrown in. The retailer will pay store and service employees an extra $2 an hour for working peak days of the holiday season https://t.co/4GN9ifRGGV @melissa_repko #target #retail #workers

— Albert Fong (@albertfong98) October 5, 2021

Like Walmart, Target’s share of voice increased in September amid its holiday prep news. BrandGraph shows Target’s share of voice climbing above average in September and is expected to hit 40% by October.

BrandGraph 500 - Top 50 Brands by Content Volume - September 2021

- YouTube

- TikTok

- Disney

- Amazon

- Target

- Walmart

- Apple

- Amazon Fashion

- Poshmark

- iPhone

- Disneyland

- Cricut

- Netflix

- Starbucks

- Etsy

- Spotify

- Walt Disney World

- Nike

- Drake

- Dollar Tree

- Costco Wholesale

- Star Wars

- Minecraft

- Whole Foods

- Oreo

- Sephora

- Patreon

- Bitcoin

- WW

- Airbnb

- Twitch

- Morphe Cosmetics

- IKEA

- Samsung

- Pottery Barn

- Benefit Cosmetics

- Mickey Mouse

- ASOS

- Mercedes-Benz

- Fortnite

- Discord

- Xbox

- PayPal

Get more insights

BrandGraph helps you measure your brand’s social media performance, benchmark against competitors, identify influencers and analyze sentiment. See the full BrandGraph 500 and get started today.